Recommendations

Set ESG KPIs and SMART targets in line with what matters to focus attention on improving sustainability performance: Best in class companies show a holistic view of their sustainability performance by integrating ESG with financial metrics and disclosing performance against these metrics.

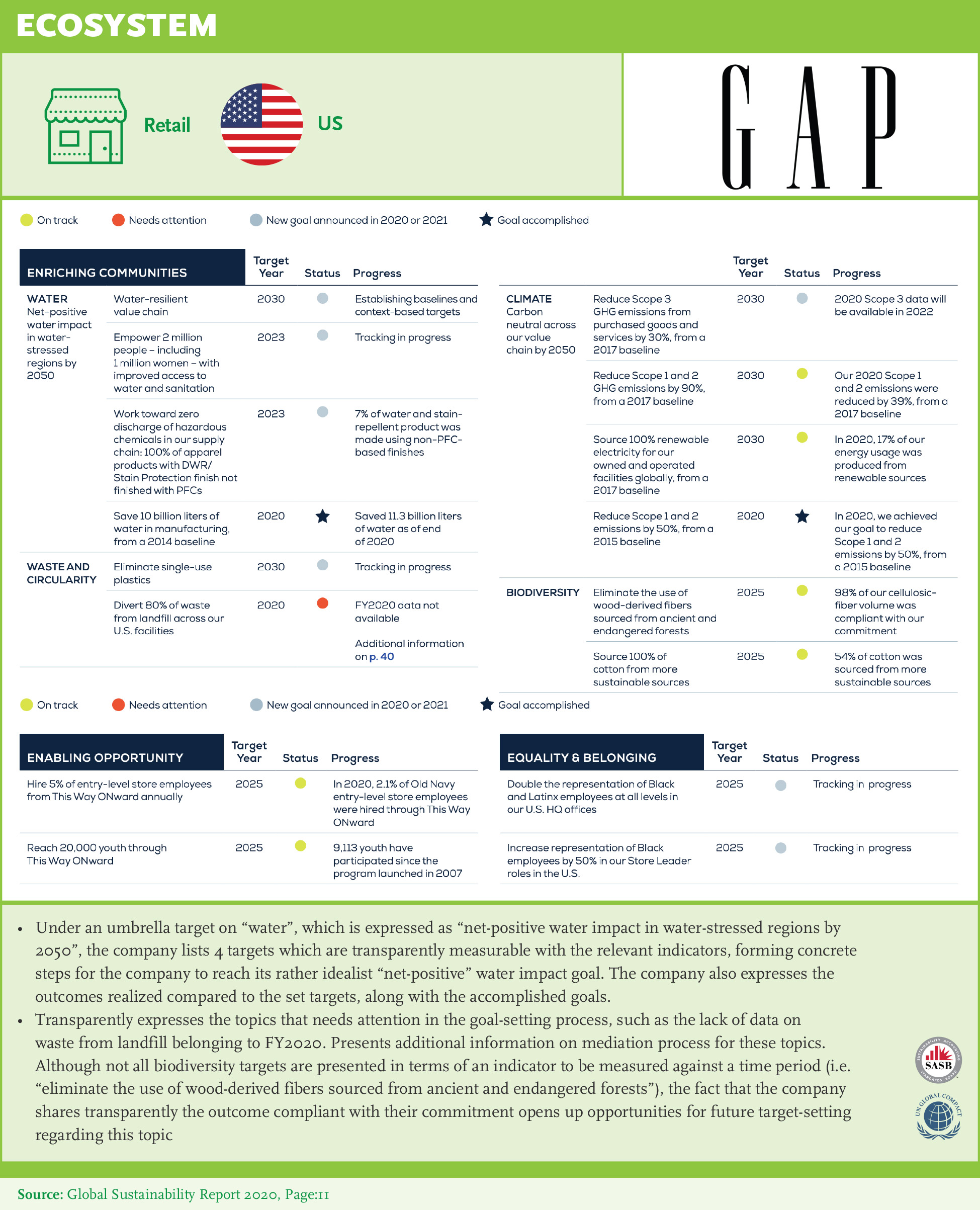

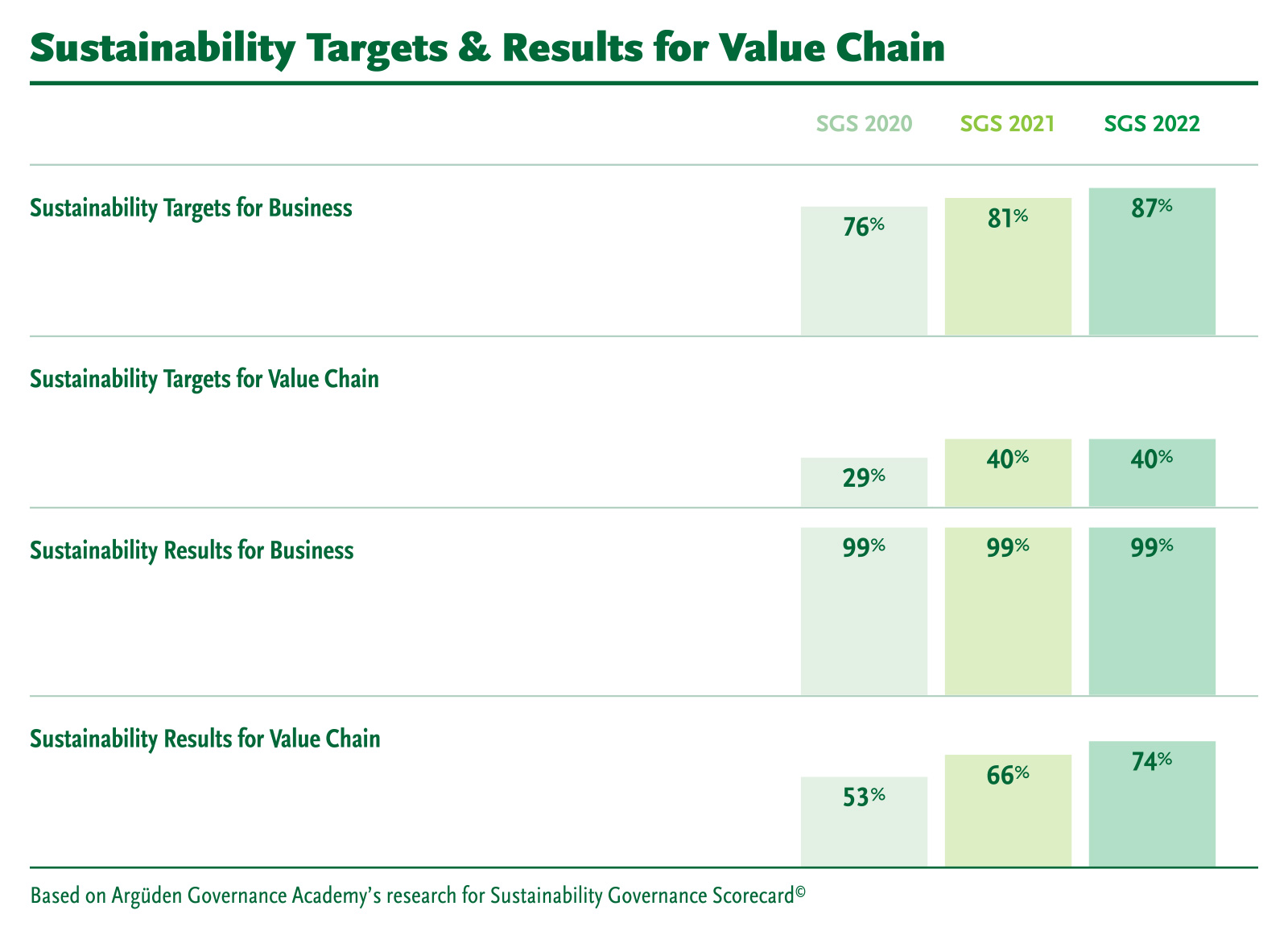

What gets measured gets improved: Set targets, report results, and monitor progress on ESG related outcomes. Targets should be relevant, meaningful, measurable, and sufficiently challenging to drive performance. Companies should report past results as well as future targets to enable investors to assess ESG performance.

Assess results and share remedial action to address gaps: Learn from peers, disclose trends and benchmarks to improve sustainability performance.

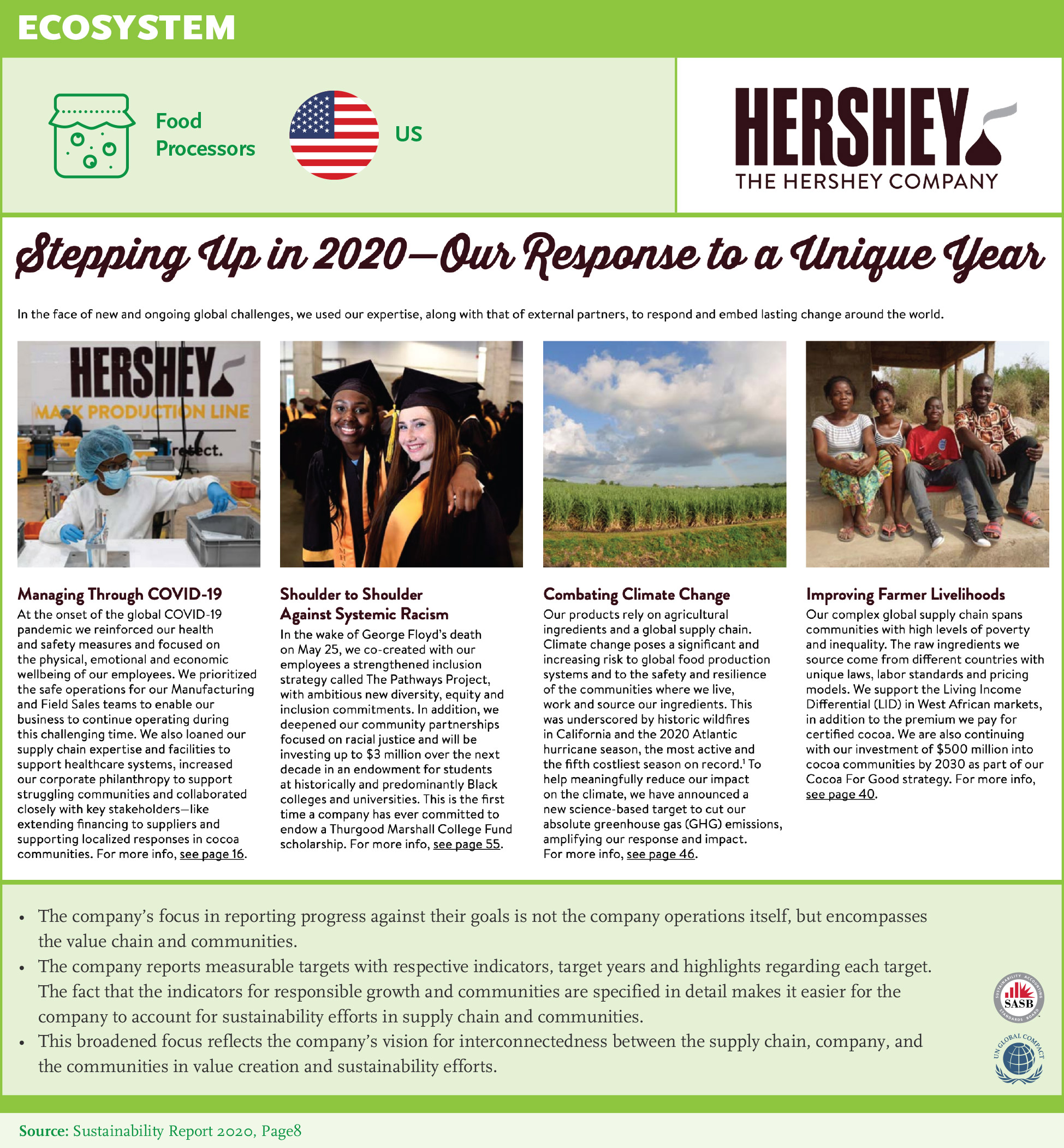

Cover all employees, geographies, and supply chain: Define KPIs, set targets, measure and report results on the supply chain. All stakeholders must be empowered and moving towards the same direction in order to achieve sustainability goals.

Develop a reliable, consistent set of indicators to measure intangibles (eg: corporate culture, human capital, diversity, and inclusion): Through consistency in reporting standards, data becomes comparable and useful for measuring and comparing performance across different areas. More consistency is required in reporting metrics for biodiversity and hazardous materials (environment), human rights and diversity (social) and compliance metrics including anti- corruption and ethics (governance).

Cooperate for the development of a unified reporting framework: Standardization and comparability of sustainability data, methodology and metrics. Investors want financial materiality, consistency (comparability, alignment of standards) and reliability (rigorous audit). Further simplification of reporting frameworks is necessary to enable comparison between a company’s performance and ease of understanding so it can be used as an input for decision- making. Simplification would also be beneficial in terms of time and cost efficiency.

Pursue sectoral collaboration to define what matters and invest in measurement and reporting systems: For sustainability reporting to be effective, what matters should be defined for different stakeholders and reporting should be done accordingly. Sectoral partnerships can enhance the clarification of metrics relevant for industry as well as reduce cost in developing methods to measure performance. There should be a push for improvements in consistency in reporting standards, at least within the same industry or clusters, to accelerate adoption of reporting practices by other companies.

Communicate value of metrics and feedback on its usefulness for decision making: Investors should communicate the benefit of information most as a useful input for decision-making.