Good Practice Examples

Recommendations

Define the Board’s sustainability responsibilities: To provide oversight over material sustainability issues, boards should clearly define their sustainability responsibilities through a ‘Sustainability Charter’. The Charter should clearly specify the scope of the board’s oversight of sustainability issues; specifically reference the company’s priority sustainability issues; make linkages with the business strategies and priorities; and provide a framework for integration with the company’s risk management systems.

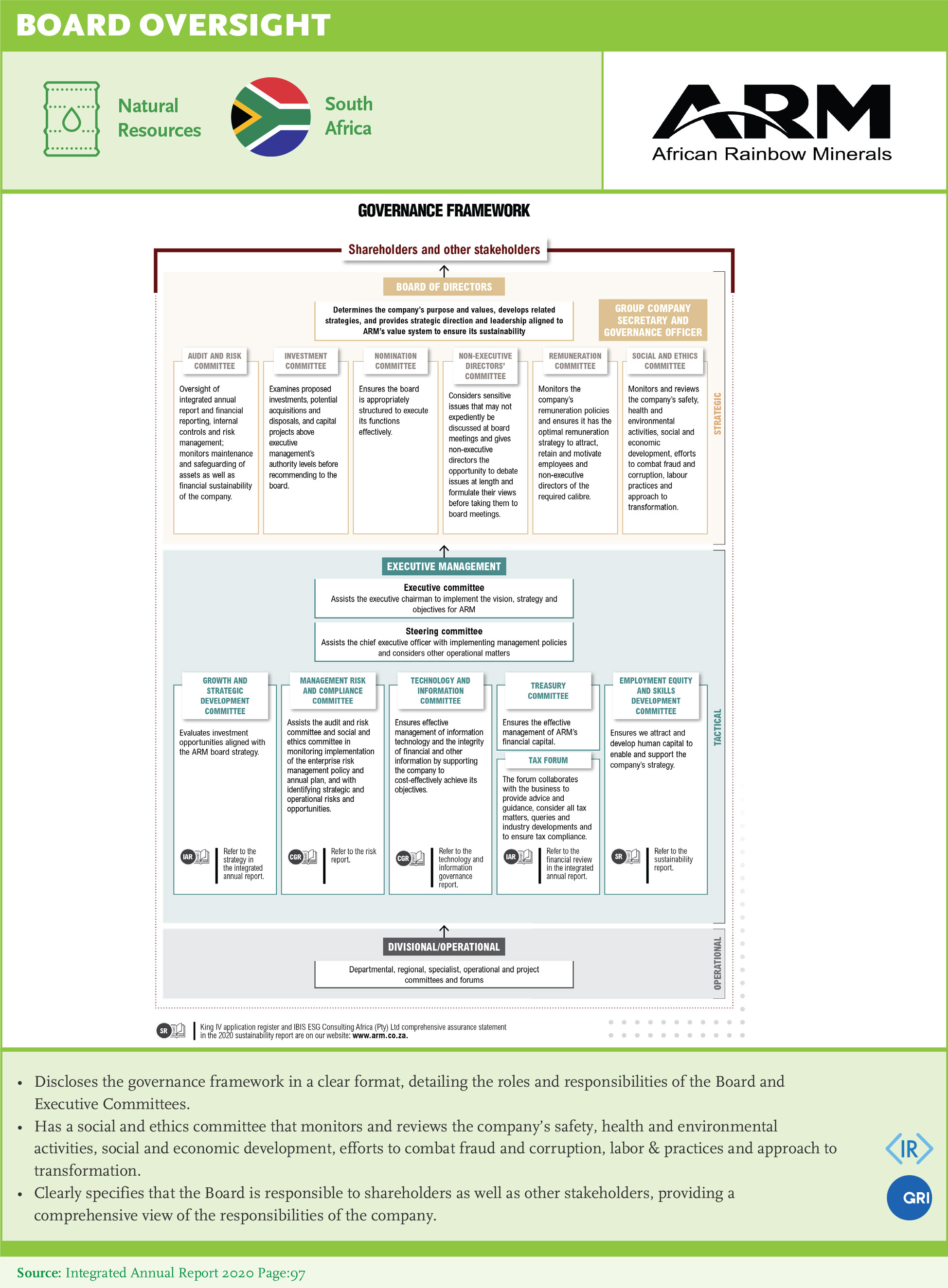

Set up formal structures and ensure regular board review of ESG issues: ESG review should be a board priority and boards need to allocate sufficient time and resources to deal with the sustainability risks and management plans to address them. GSLs tend to establish separate board committees to provide sufficient attention to sustainability matters and bring key issues to the full board. Initial role of the sustainability committee is to establish the system, in time – as sustainability becomes part of doing business, structure can change (specialized issues to follow investments and innovation).

Cascade sustainability responsibility across the organization: A top-down approach to sustainability and good governance is not effective unless it is supported by a bottom-up approach that rallies around ESG initiatives, consistently implemented across functions, divisions, and business lines.

Focus on risks and opportunities: The boards also need to provide sufficient oversight to the management’s identification of risks and opportunities of sustainability issues, including those related to strategy, regulatory and legal liability, product development and pricing, disclosure, and reputation, as well as the management’s action plans. In doing so, the boards’ unfettered access to outside experts should be assured.

Information quality determines decision quality: The board should be presented with information not just on financials, but also information about the level of intellectual capital and reputation of the corporation and supplier. Customer, employee, and community satisfaction surveys are also required for quality decision making. Generally, these types of information may have greater relevance for the future value of the corporation and for the board members to fulfill their stewardship roles. Information flow to the board needs to be relevant, context-based, timely, balanced, and comprehensive.

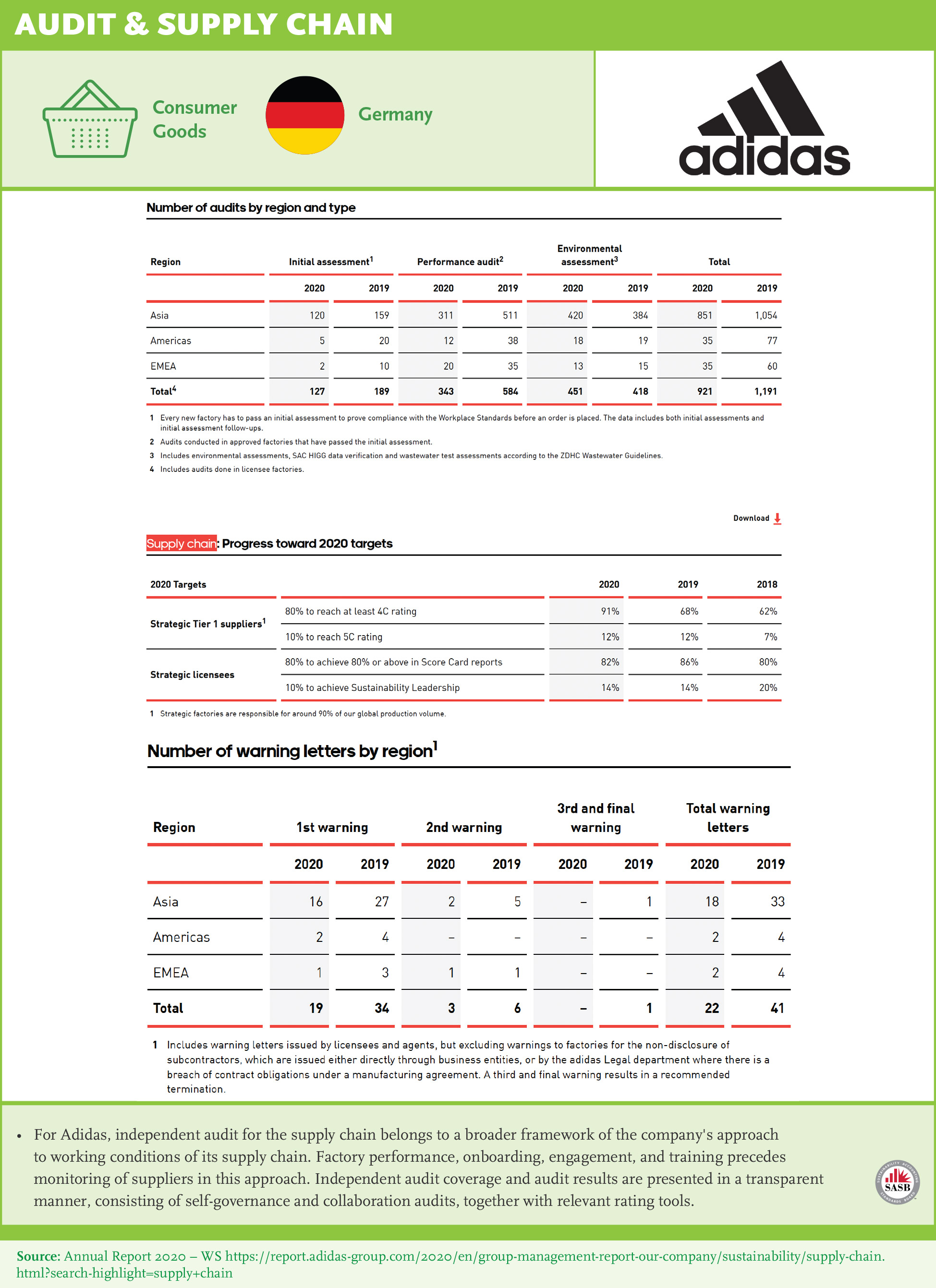

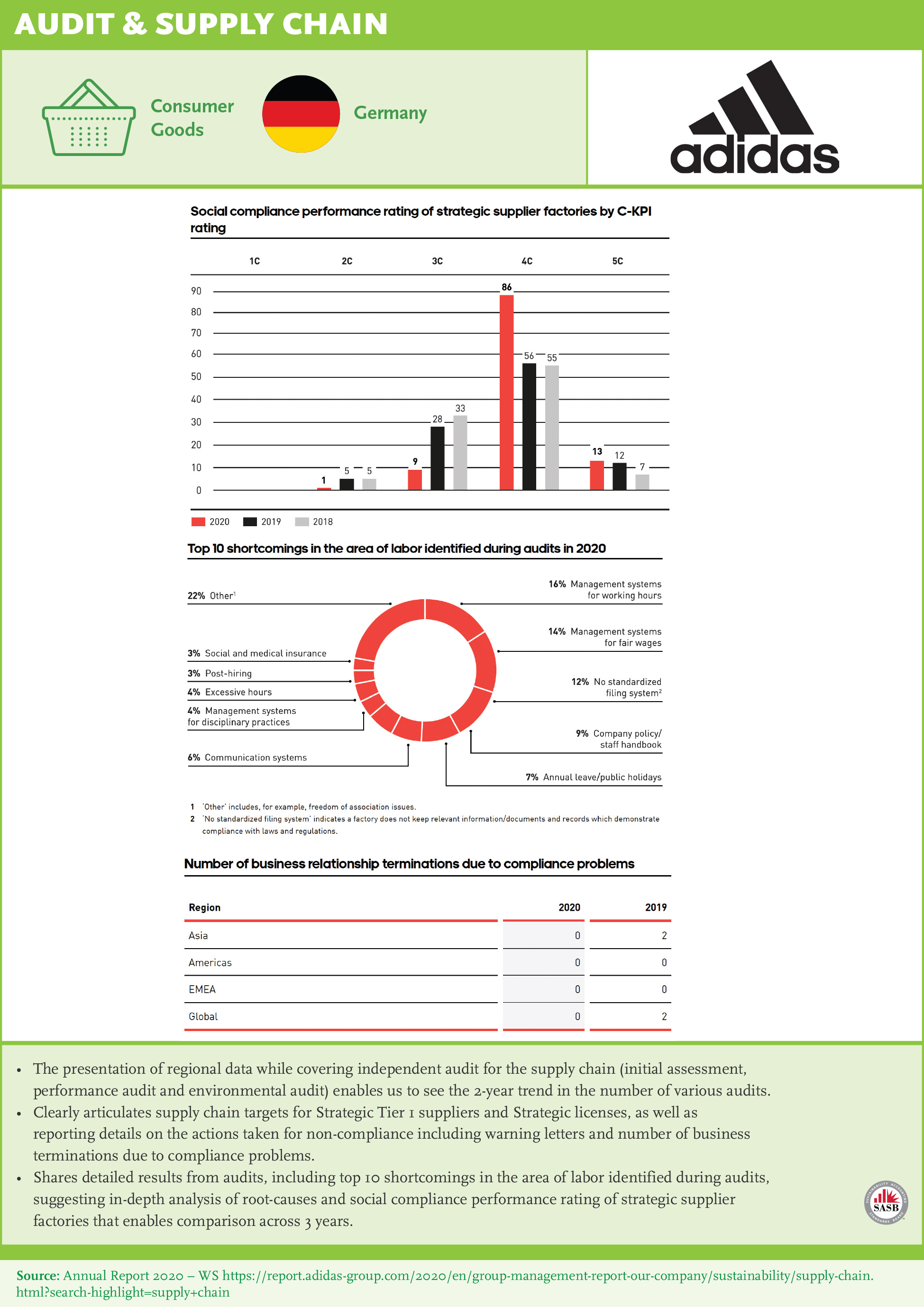

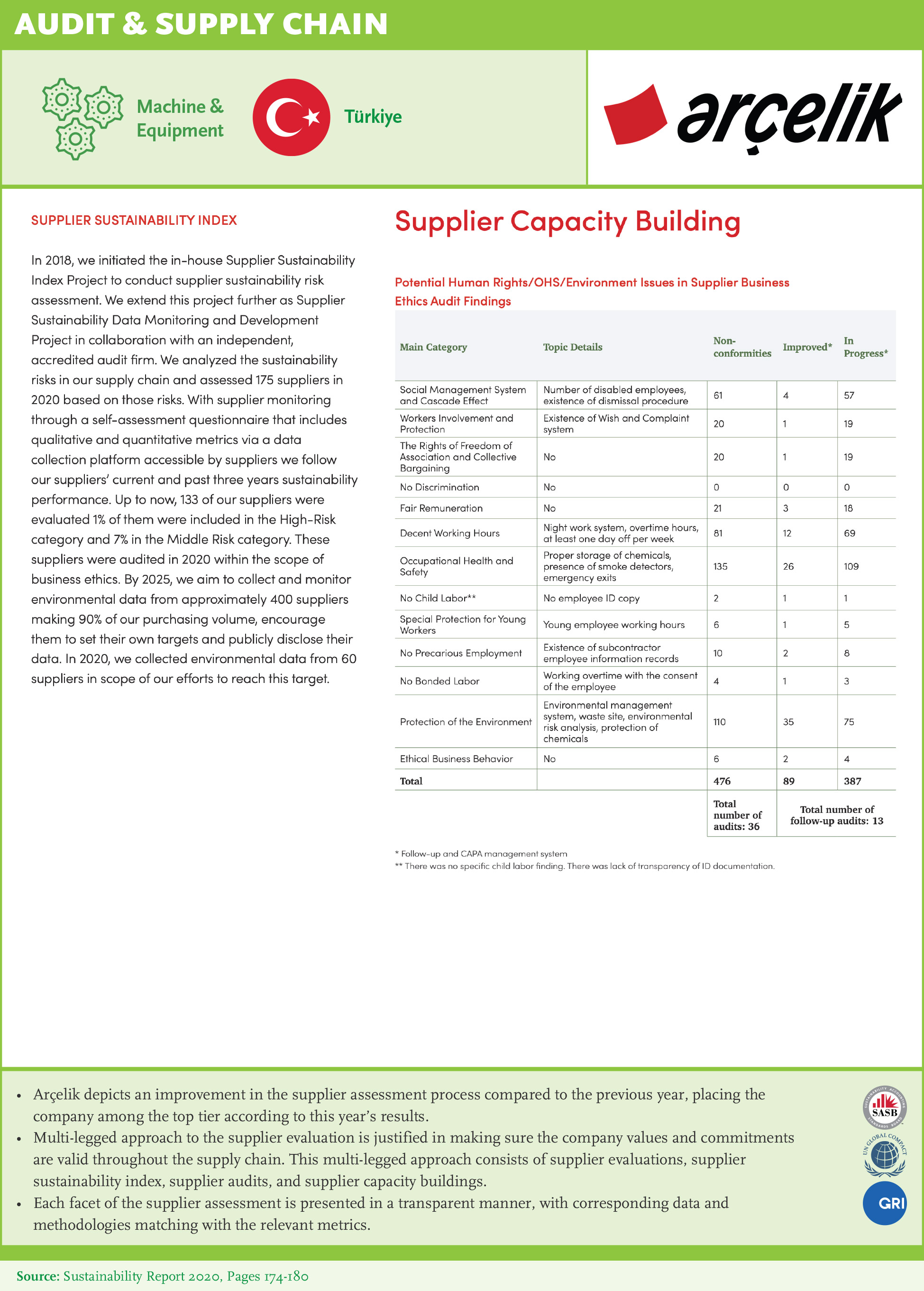

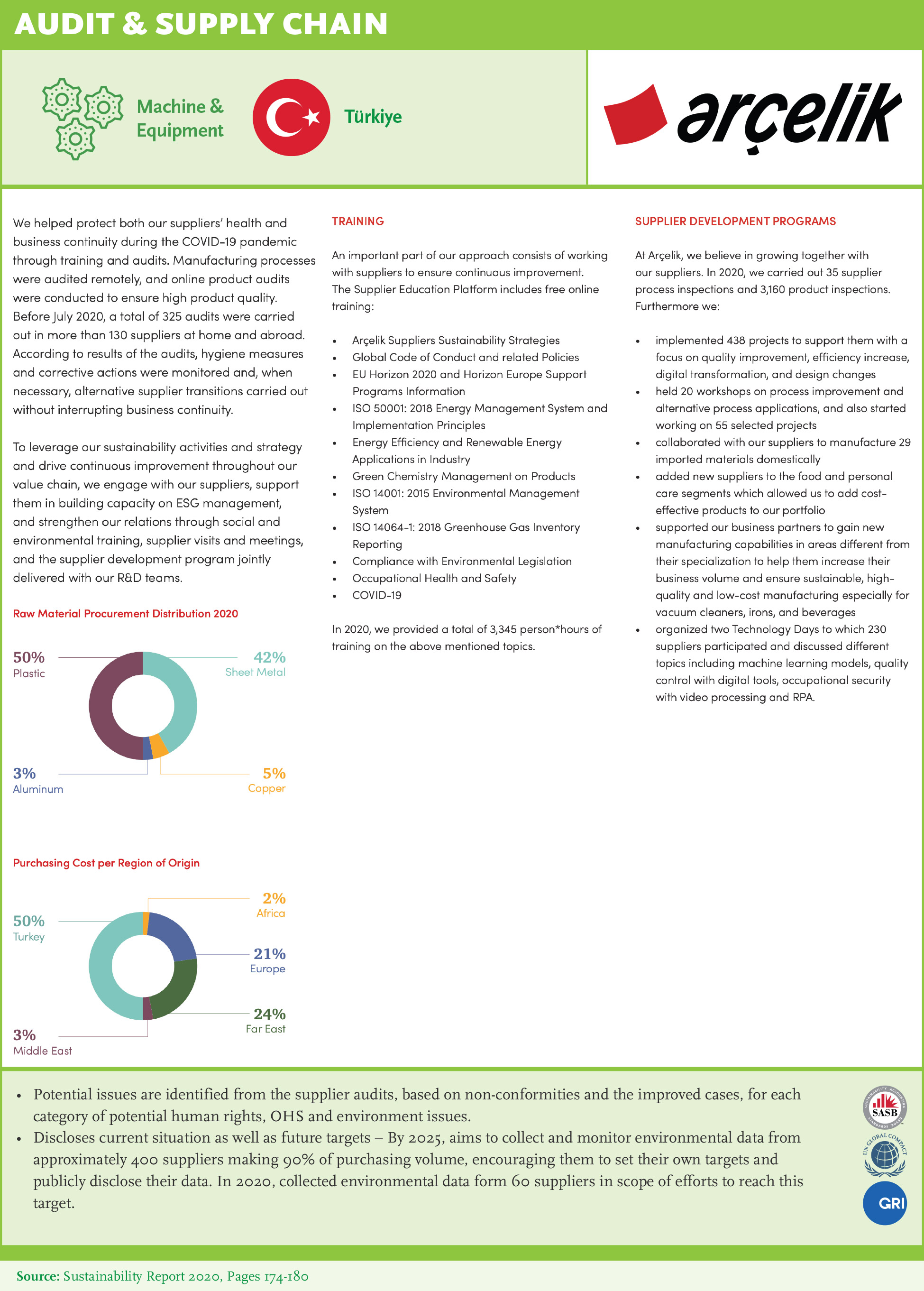

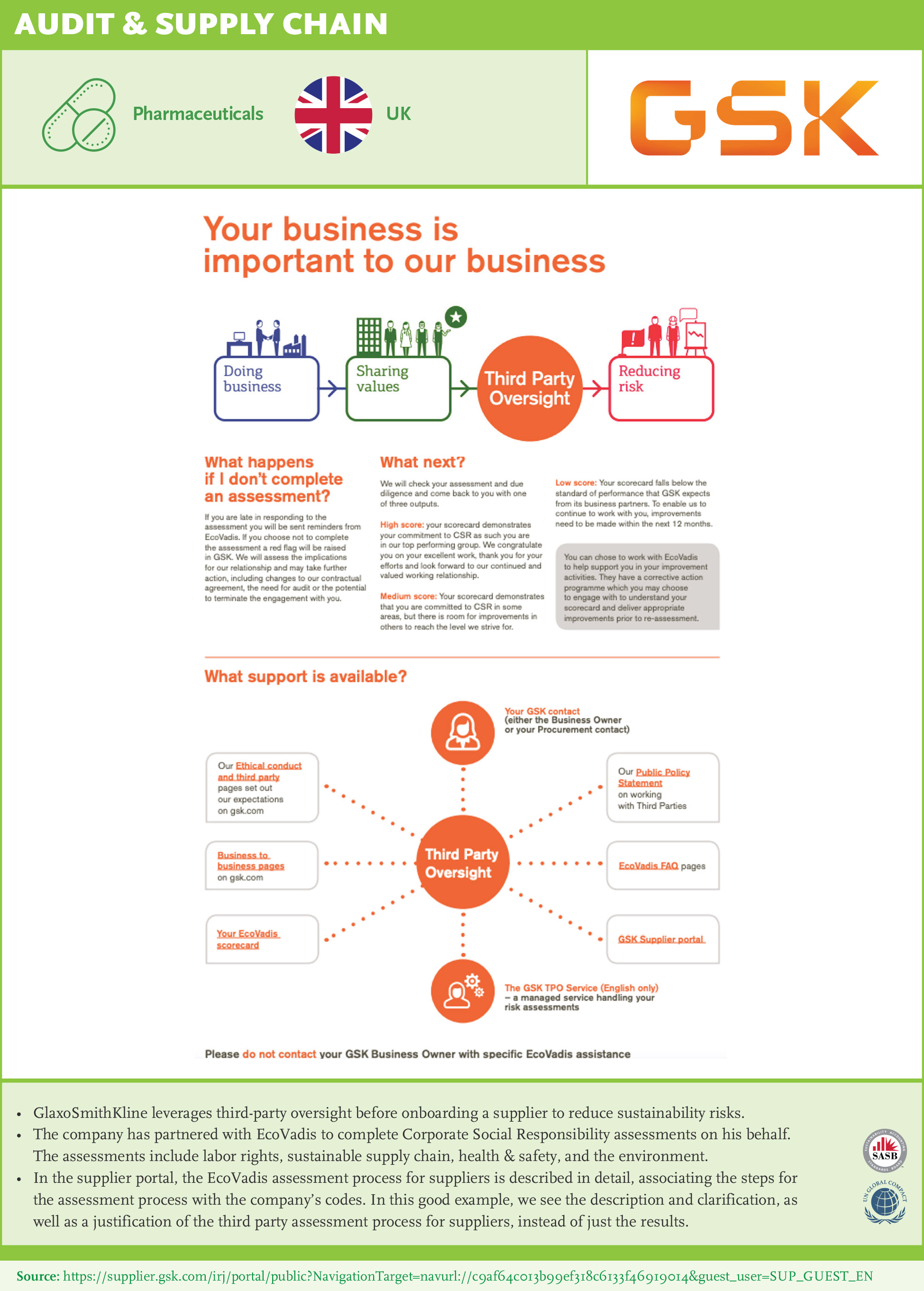

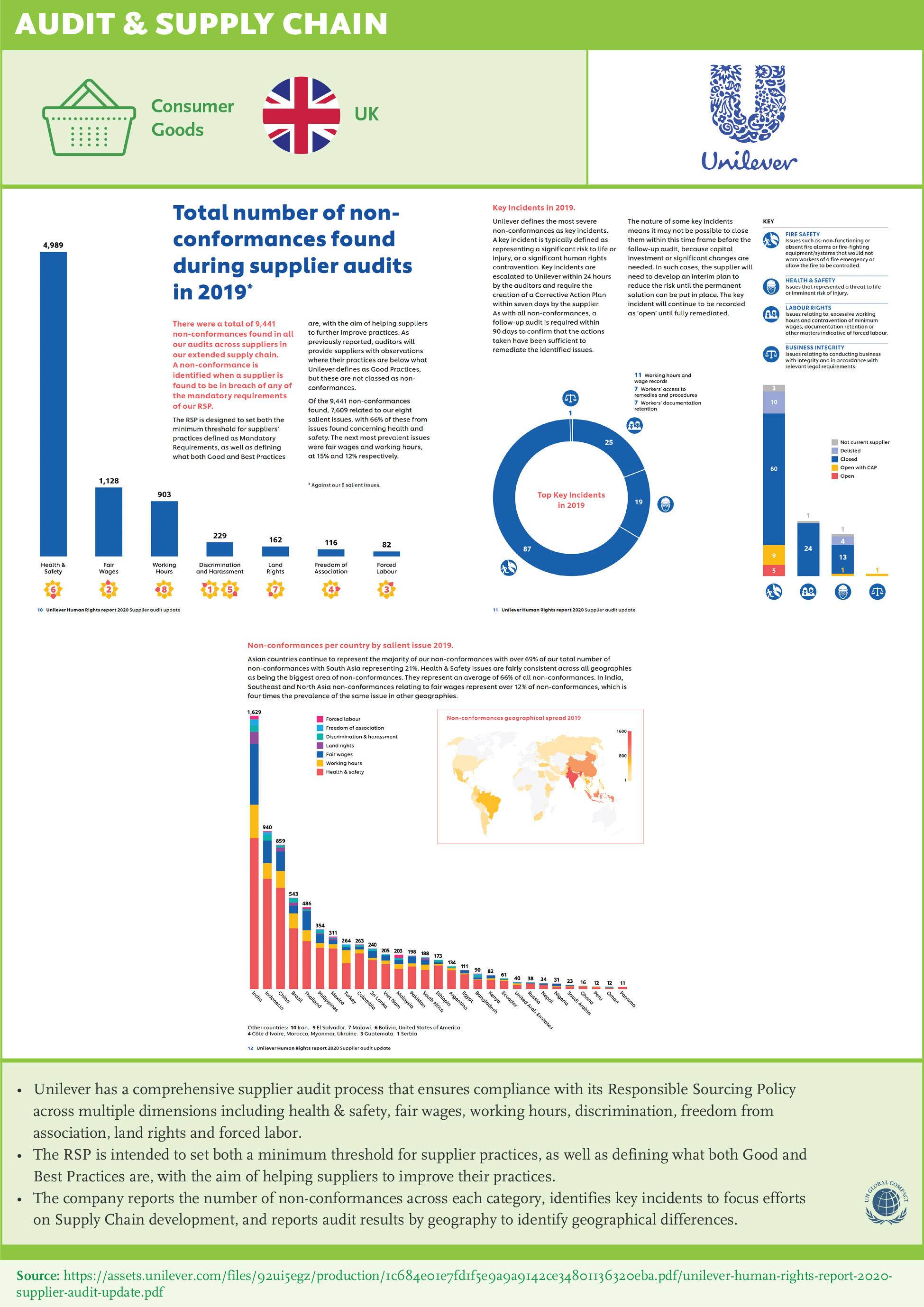

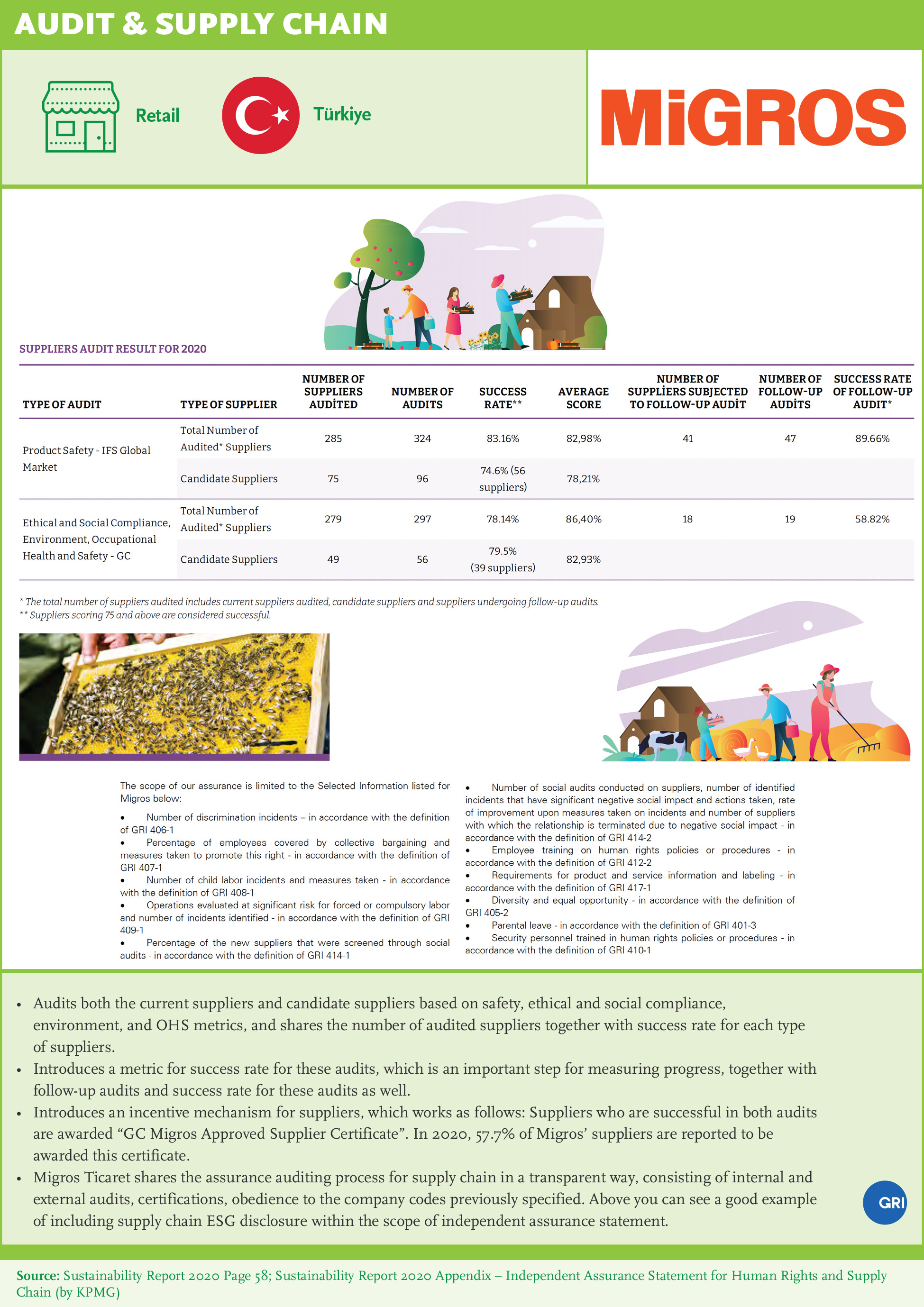

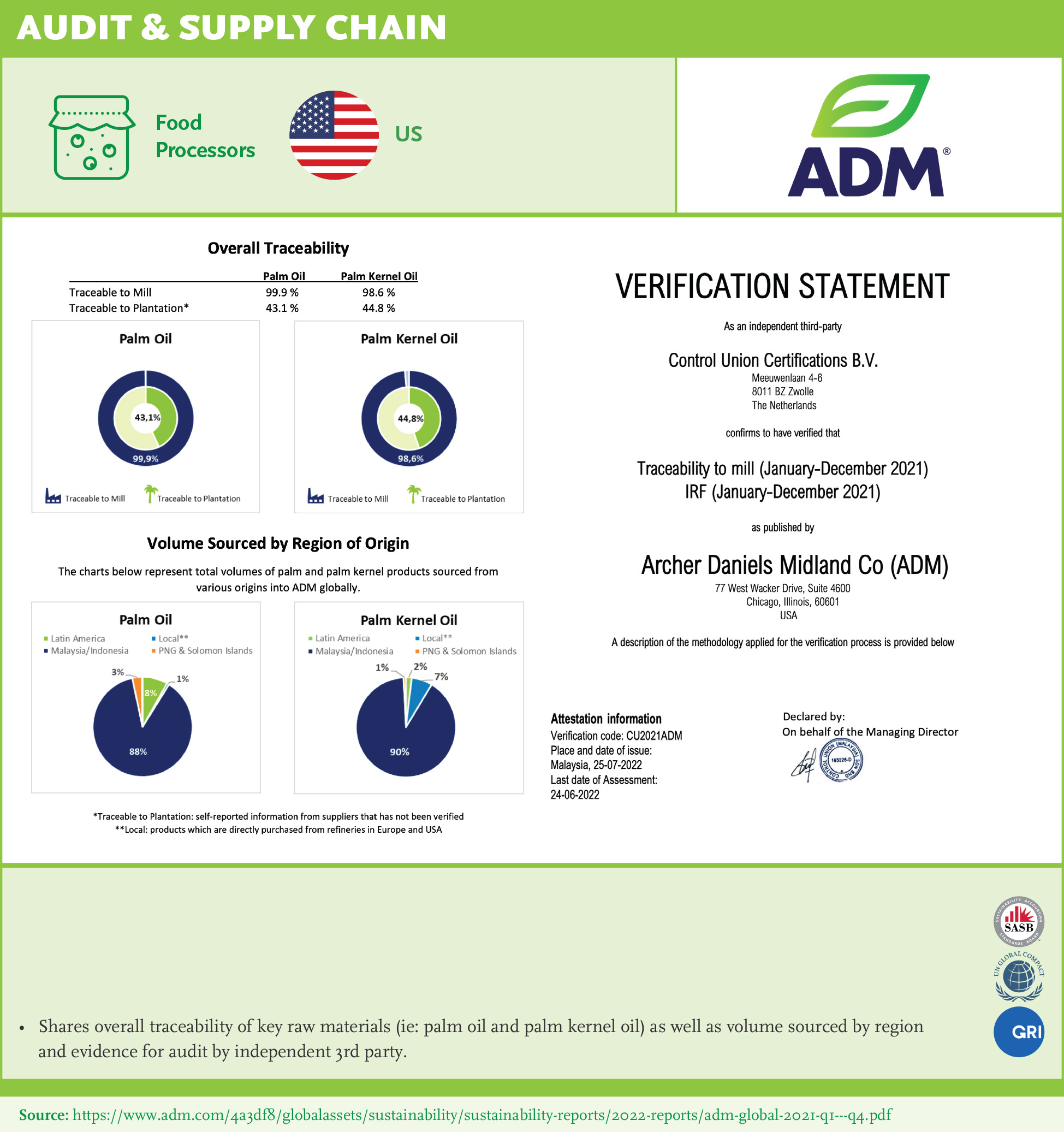

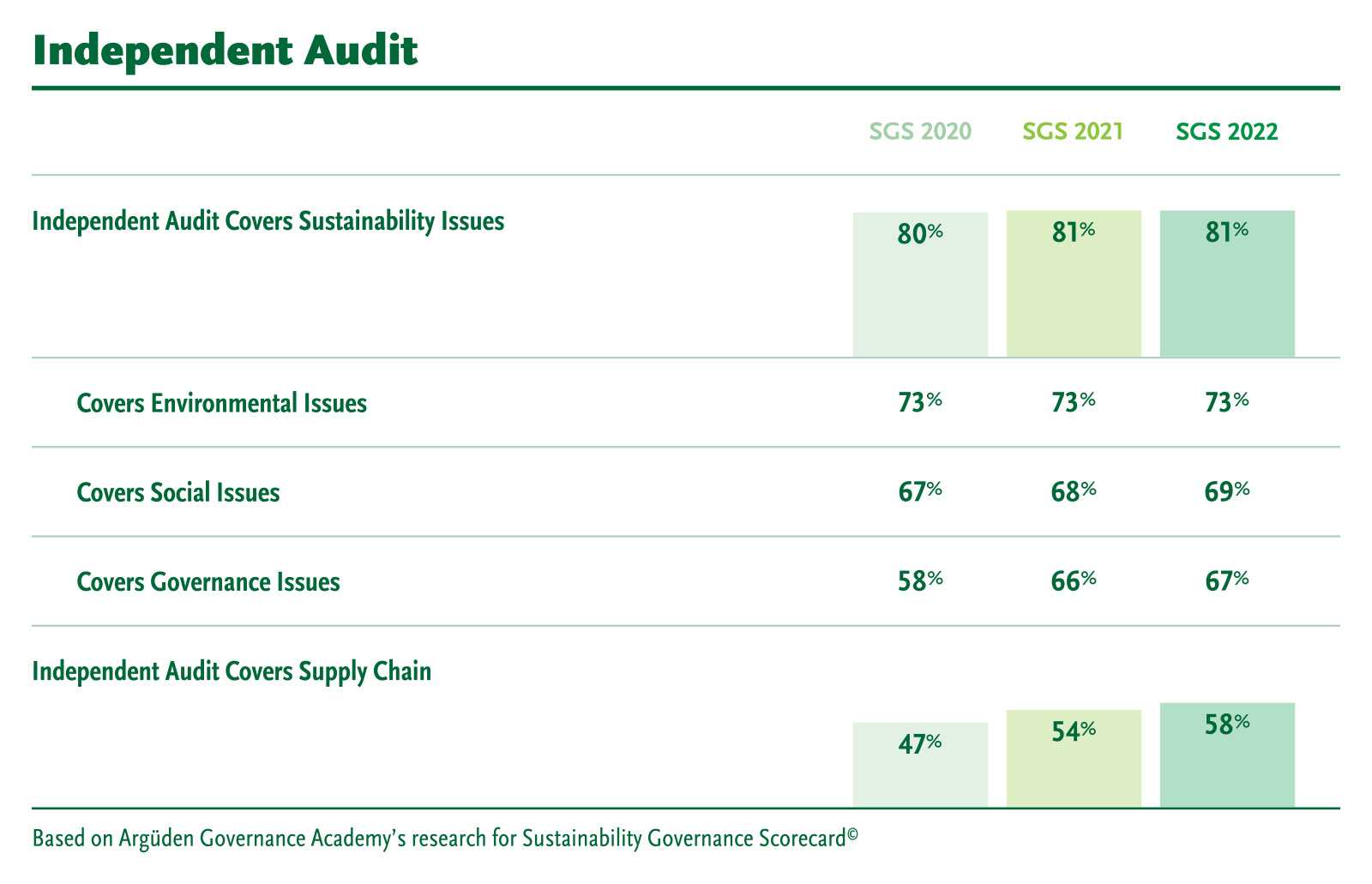

Ensure internal and independent audit covers all material ESG issues, supply chain, and geographies: In order to exercise their oversight responsibilities, the boards should receive findings and recommendations from any investigation or audit by internal audit department, external auditors, regulatory agencies, corporation’s insurance companies, or third-party consultants concerning the corporation’s sustainability matters on a timely basis. Internal audit should focus on both financial and process related issues to improve implementation and play an advisory role. Internal audit function must have direct access to the board. Audit Committee charter should cover compliance and sustainability related issues. To provide effective oversight over sustainability issues; the Board must ensure that independent third-party reviews cover environmental, social, and governance issues.

Conduct board evaluation, integrate ESG issues into board evaluation and disclose results: The board deliberations should also include evaluation of the adequacy of the D&O insurance package to sufficiently protect the directors against liabilities arising from sustainability issues. Boards should institute a learning and continuous improvement process for their own operations by incorporating the recommendations of the insurers into its sustainability plans and by conducting a regular self-evaluation exercise that evaluate the board’s approach and effectiveness in providing guidance and oversight on sustainability issues. Many companies utilize independent third-party experts to help conduct a comprehensive and objective self-evaluation process.