Recommendations

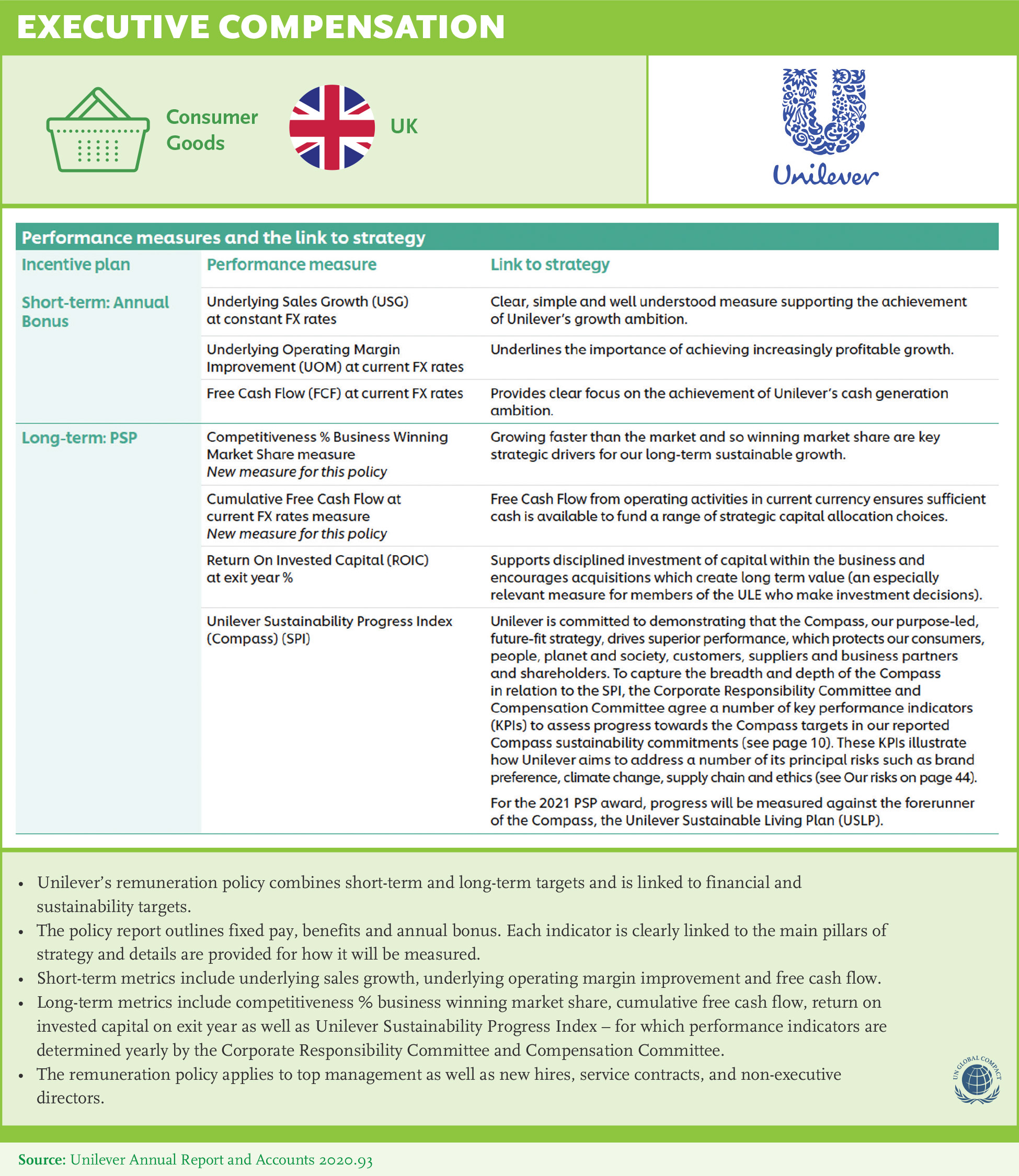

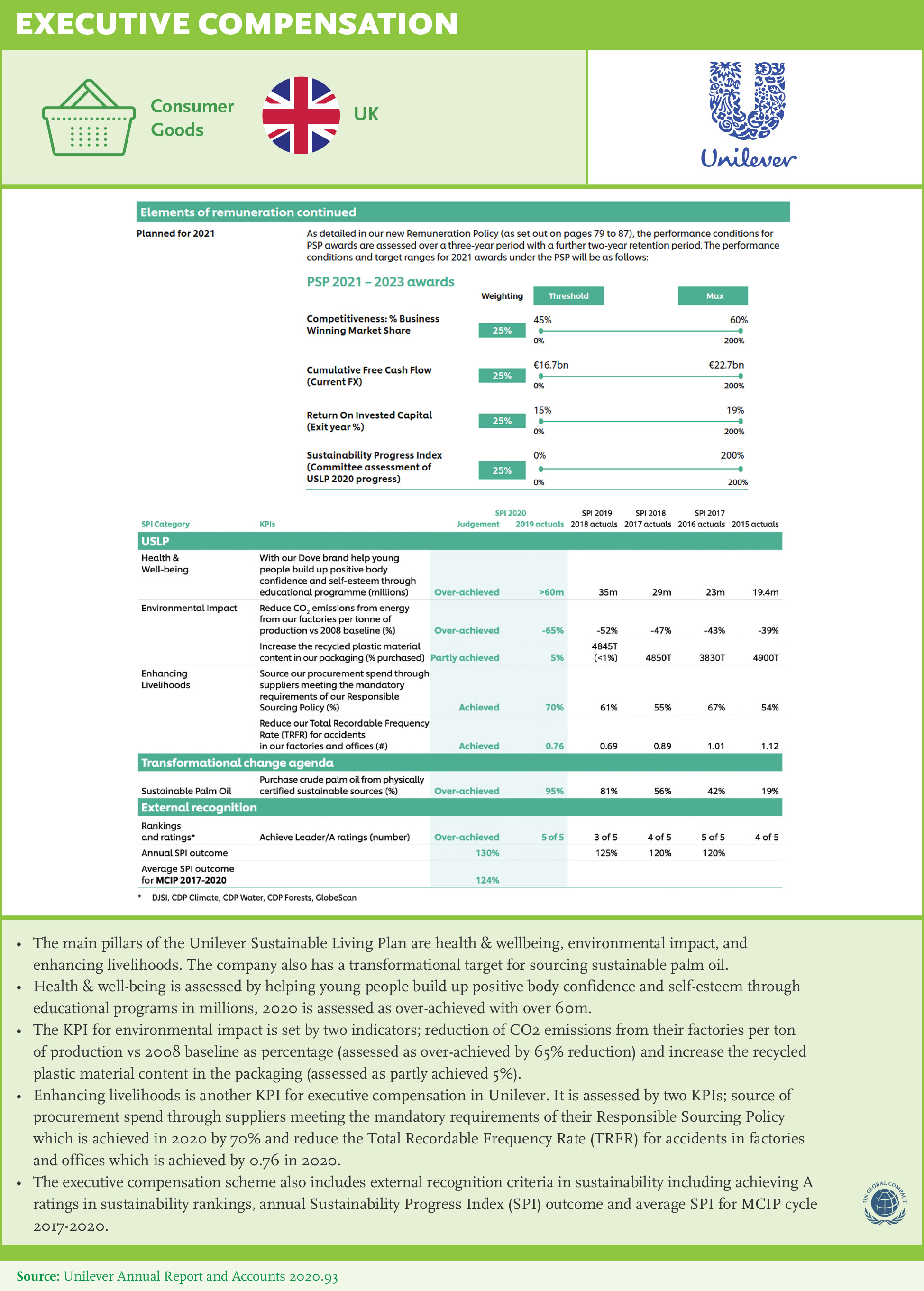

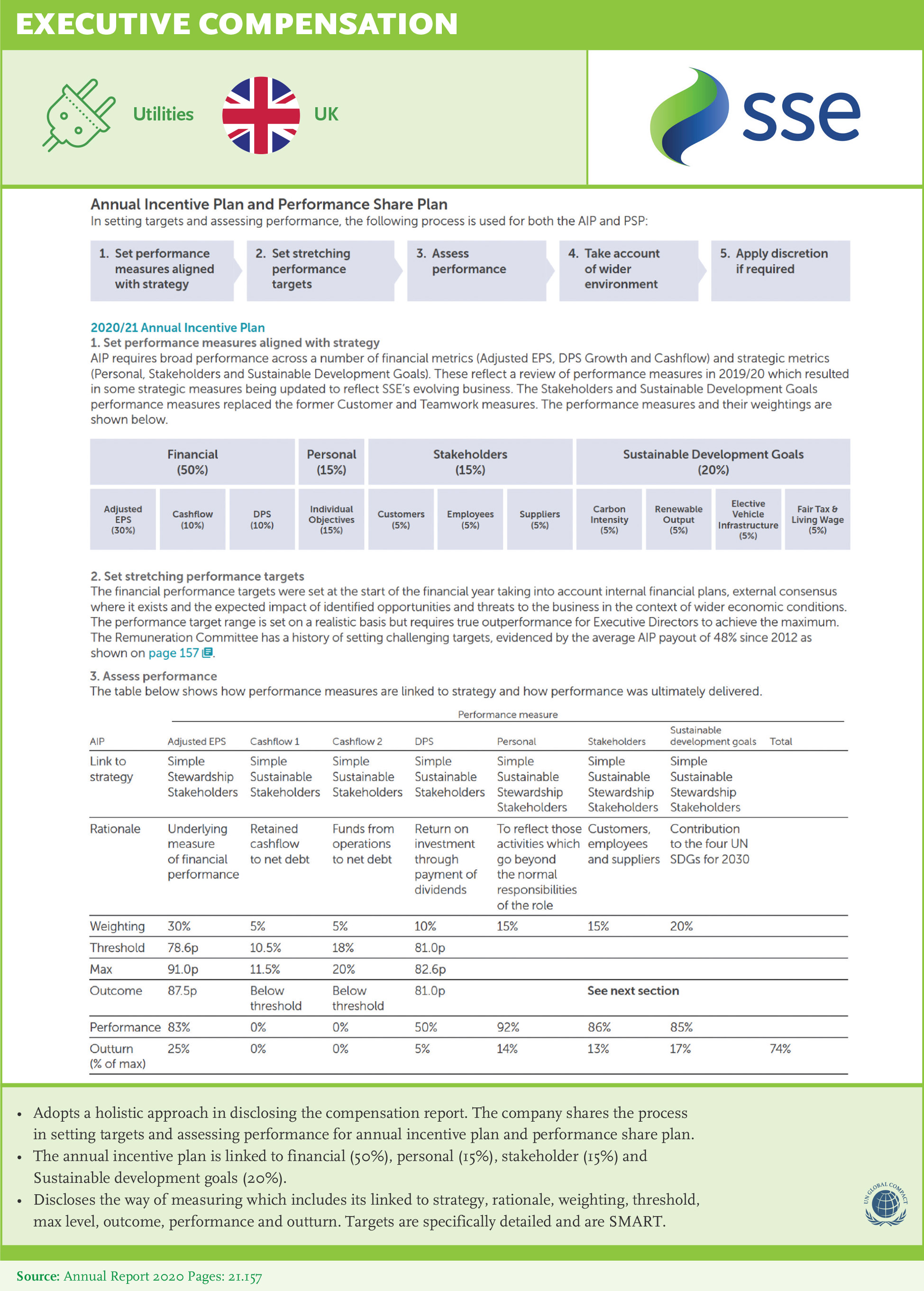

Identify appropriate ESG metrics material to financial performance and aligned with long-term strategy: Metrics should be defined on issues most relevant and material to business. For example, CO2 emissions can be more material to companies in the coal industry, while health & safety for Mining and Construction, or workforce diversity in consumer goods. Best-practice examples demonstrate how the selected metrics are related to strategy and performance objectives.

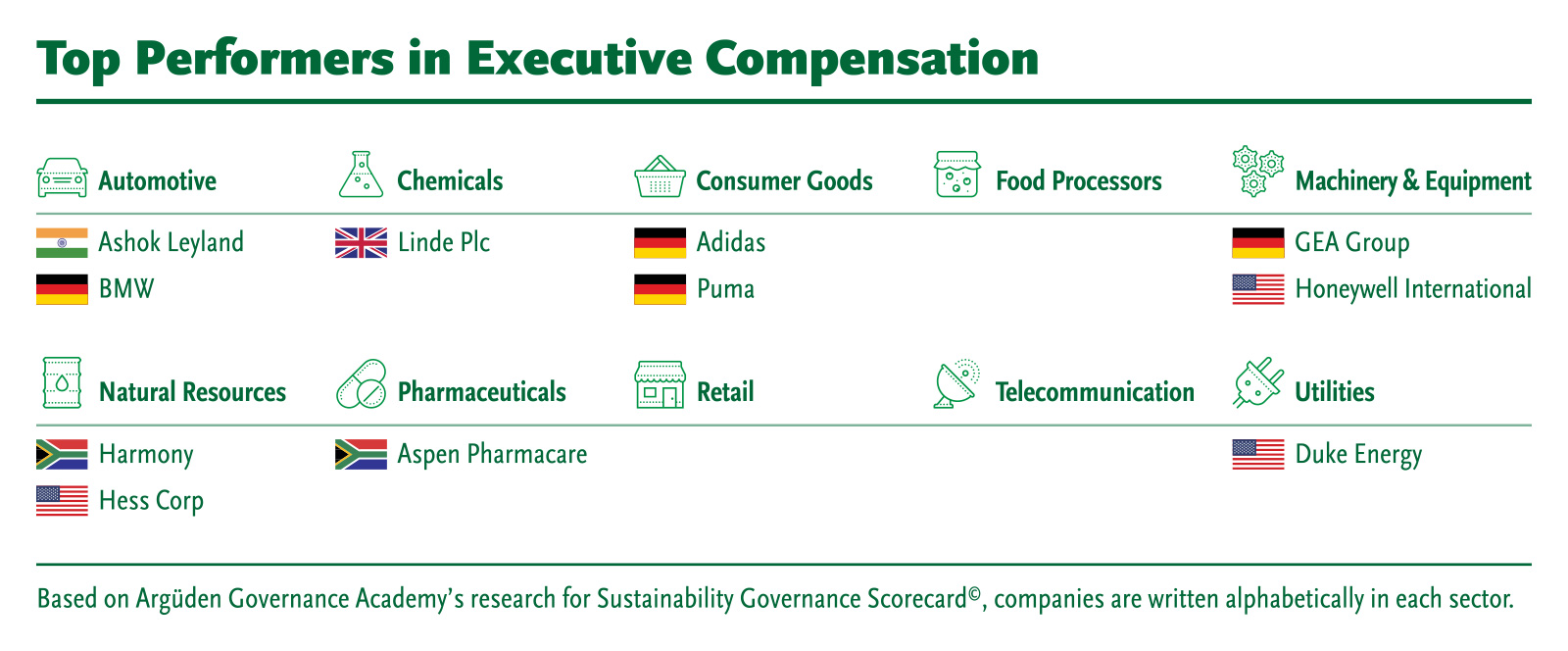

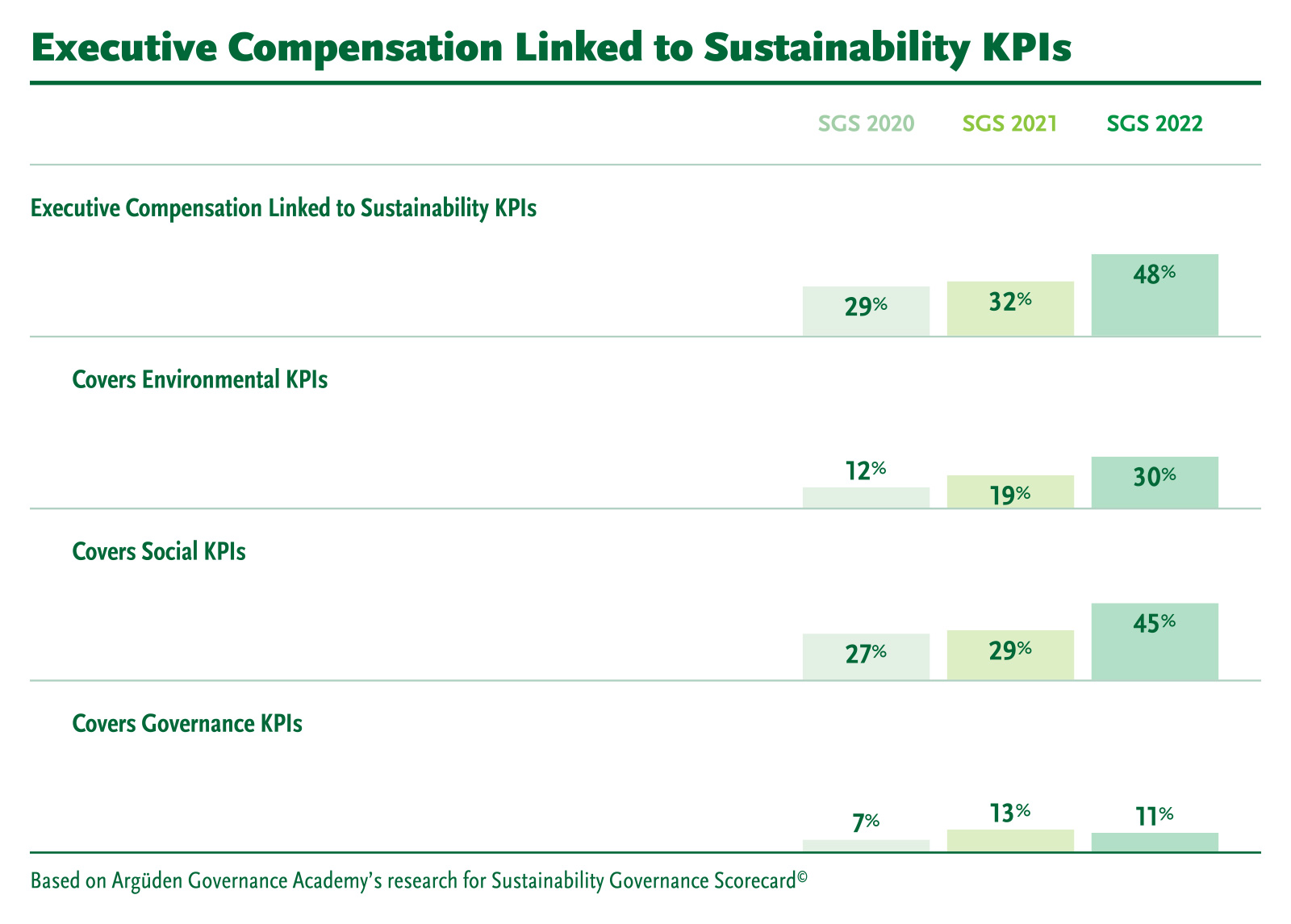

Link Executive Compensation to material sustainability/ESG targets: To improve corporate accountability for sustainability and focus management attention, tie executive compensation to material ESG targets. Best-in-class companies:

Select metrics that are forward looking, clear, available, replicable, comparable, time-bound.

Make sure sustainability metrics are a meaningful component of the overall remuneration framework with appropriate time horizon in line with business strategy and challenging to incentivize outperformance.

Set both short-term vs long-term targets: Sustainability targets require long-term planning as well as immediate action.

Provide high-quality disclosure to signal commitment to sustainability: Best examples from GSLs clearly disclose rationale with metrics in line with business strategy and allow sufficient information for investors to assess performance and pay-outs against ESG goals. Benchmarking with industry peers and disclosing executive compensation as a multiple of an average employee’s salary are examples of ways companies make this information useful for investors.

Integrate sustainability into the performance management systems of the entire organization: Linking executive compensation with sustainability metrics is the first step; to move the entire organization towards sustainable value creation, performance management systems must be aligned for the entire organization.